By any measure 2001 was a challenging year for investors. For the second year in a row, major equity markets worldwide suffered double digit losses. The event that marked the year was, of cause, the September 11th attack. In addition to the human and financial toll, the attack forced the longest suspension of trading that the US stock market has seen since the days of the Great Depression in 1933.

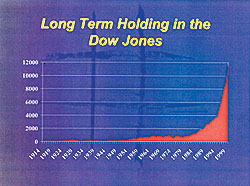

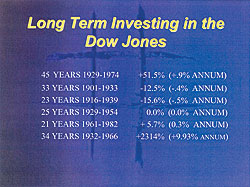

Does this mean you should not be invested in equity market? Absolutely not. Perhaps the most important lesson is that the cost of not being can be huge. It is very easy to miss some of that strongest market rises—the ones that generate the high returns associated with long term equity investments. Markets anticipate future events and tend to recover sharply after periods of poor performance.

The good news is that for over 60 years, the major market indices have never fallen for more than two yeas in a row. The last time this occurred, fascism was sweeping through Europe and the Great Depression was still a recent memory. Nothing so frightening is happening today. 2002 began with a much more positive landscape than that of just a few months ago. Interest rates in the US are at the lowest level for 40 years, oil prices are low and inflation across the developed world is modest. However, one cannot ignore a number of major risks. Major concerns include the level of consumer and corporate debt in the US, deflationary pressures( particularly with regard to Japan and its ongoing debt crisis), the slow pace of structural Europe and stock market valuations that on some measures(such as p/e ratios) are still at the very high end of historical ranges.

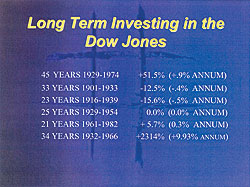

On March 4th it was 484 trading days since the Dow Jones Industrial Average hit a record high-the longest such case since the bull market began in 1982. Could we be witnessing a repeat of the 1965-1982 era,swheresequity markets went sideways or backwards for years? Despite recent signs of economic recovery, the Dow is off more than 1.000 points from its record high and the Nasdaq is 60% below its peak.

The bear case is that the equities became fundamentally overvalued during the late 1990s. Since valuation measures tend to revert to the mean, that ensures a long period of long dismal equity returns ahead. Furthermore, the creation of a“credit bubble”during the 1900s has inflated asset prices. This bubble has created enormous imbalances in the US economy, notably a private sector financial deficit and a wide current account deficit. As companies and individuals work off this debt burden, the US faces a prospect of sluggish economic growth and deflation.

While such bearish sentiments remain a minority view, there are sound reasons for caution about long-term equity returns. Returns were boosted in the 1980s and 1990s as the world moved from high inflation to low inflation. From here, any kind of change would not be good news for equities. A return to inflation would push up yields and bring share prices down; a move to deflation would put pressure on corporate profits.

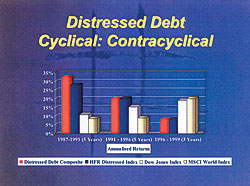

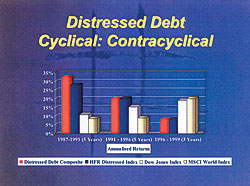

Even if we assume that low inflation can be maintained, we can expect single-digit returns from equities over five years or so. Traditional investment managers face a growing competitive threat from hedge funds which claim the ability to produce positive returns in falling or rising assets markers, thanks to their ability to go short (bet on falling prices).

The bull market wormed its waysintosso many areas of economic life. While the bears remain in the minority, there are few commentators who expect a return to the go-go years of the 1990s. For those who built their habits and business on rapidly rising share prices, the challenges are just beginning.

On Wednesday, April 10, 2002, Tenbridge Consulting held a seminar entitled“Beating the Bank”at the Capital Club, a prestigious club in Beijing, to present information about how even in these volatile market conditions there are safe investments that provide consistent and greater returns than keeping one’s money in the bank. More than 50 expatriates from the UK, Europe, Australia, Scandinavia, Canada, the US and Asia attended the seminar.

The evening started with a presentation by Stuart Borchard, Sales Manager of Royal & SunAlliance, who provided an overview to dollar-cost averaging, the benefits of regular saving and non-market based funds. Joyce Ip, Vice President of Momentum Asialink, then provided an introduction to Momentum funds, which are not equity related and have achieved very consistent growth over the past 5 years. Momentum funds are‘hedge’funds, which use put and call options to make gains in a volatile marketplace. Russell Brown, Managing Partner of LehmanBrown accountancy firm then discussed tax implications of investments, as well as the use of tax vehicles such as trusts, off-shore investments and domestic tax strategies to minimize tax obligations. The three headline speakers provided informative and useful information for both the new as well as the seasoned investor.

Tenbridge is holding a series of seminars about investing in these unpredictable market conditions. A portfolio strategy that it favors is to diversify assetssintosequities, bonds and“alternative”investments while hedging against the current strength of the US Dollar.

Tenbridge Consulting is a British company founded in 1998 as an independent financial advisory firm. The company specializes in providing personal and corporate financial planning services for expatriates, with offices in both Beijing and Shanghai. Tenbridge Consulting advice expatriates on all aspects of financial planning, including lump sum investments, regular saving plans, retirement planning, education fee planning, use of offshore trusts, life assurance as well as private medical insurance.

| ![]() 本网站由北京信息港提供网络支持

本网站由北京信息港提供网络支持