双语阅读:北京重度空气污染带来投资机会

北京重度空气污染带来投资机会

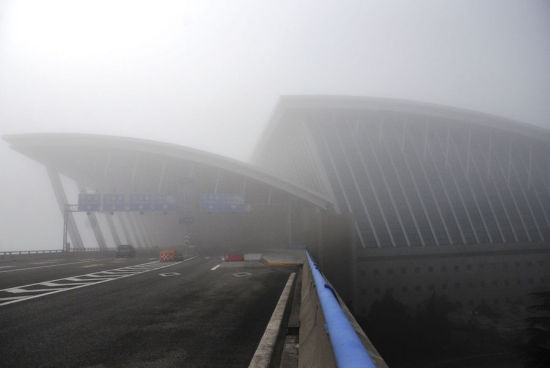

北京重度空气污染带来投资机会Private equity firms are seeking opportunities to invest in clean technology companies in China, especially those that that may help reduce air pollution long term after Beijing’s thick, grey air turned ‘hazardous’ over the weekend。

私募股权公司正在寻找在中国投资清洁技术公司的机会,特别是那些长远来看可能有助于减少空气污染的公司。上周末,北京浓厚的灰色空气转为“有害健康”级别。

One firm, Northern Light Venture Capital said it’s starting to target air-treatment companies, and is considering an investment into a Chinese air-purifier business called Beiang, which can help remove inhalable particles as small as 20 nanometers, said Managing Director Lei Yang, who’s based in Beijing。

Reuters2013年1月14日,北京市中心故宫前,人们站在雾霾中。北极光创投(Northern Light Venture Capital)说,其开始瞄准空气处理企业。该公司驻北京的董事总经理杨磊说,北极光创投正考虑投资一家空气净化器公司苏州贝昂科技有限公司(Beiang)。贝昂空气净化器可帮助去除小至20毫微米的可吸入颗粒。

Overexposure to small pollution particles, such as those known as PM2.5, can often lead to medical conditions such as respiratory infections, and may increase the chances of developing lung cancer. On Saturday night, the U.S. Embassy in Beijing recorded tiny particle matter at 886 micrograms per cubic meter, the highest level since it started to monitor the air quality in 2007.

过度暴露于PM2.5等污染微粒中往往可导致呼吸道感染等疾病,还有可能增加人们患肺癌的几率。上周六夜间,美国驻华大使馆[微博]监测到每立方米空气中的微小颗粒物达到886微克,为该使馆2007年开始监测空气质量以来的最高值。

That measure is almost 12 times the recommended standard in China and more than 25 times the standard in the U.S., the Wall Street Journal reported. At the same time, the U.S. embassy’s air quality index reading of Beijing’s air hit a high of 755 over the weekend, way above past levels of 500, which has often prompted the embassy to use ratings like ‘hazardous’ or in some cases, ‘crazy bad.’

《华尔街日报》报道,这个水平几乎是中国规定的正常范围的12倍,是美国标准的25倍以上。同时,美国驻华大使馆上周末监测到的北京空气质量读数高达755,远高于过去500的水平。该使馆也因此经常使用“有害健康”这样的评价,甚至“糟糕得令人发疯”。

Although private equity investment into clean technology companies in the U.S. is expected to slow this year, especially after venture capitalists saw solar company Miasole sold at a loss, the opposite is likely to happen in China, agreed industry experts。

行业专家一致认为,虽然私募股权投资美国清洁技术公司的步伐今年预计会有所放缓,特别是在风投资本家看到太阳能企业Miasole亏本出售之后,但中国的情况可能刚好相反。

Vishnu Amble, a senior associate at Global Cleantech Capital, which has $100 million to $150 million assets under management, and has raised two funds, said he expects to see a third of his firm’s deals originate from the greater China region, including Hong Kong and Taiwan, as companies there often have revenue and are profitable。

相关报道欧洲私募股权公司Global Cleantech Capital管理的资产规模在1亿至1.5亿美元之间,并已筹集了两只基金。该公司高级合伙人阿姆布勒(Vishnu Amble)说,他预计公司三分之一的交易来自大中华地区(包括香港和台湾),因为那里的公司不仅有营收,而且具有一定的盈利能力。

Northern Light’s Yang said that Chinese clean-tech companies usually need less capial than those in the U.S. For example, a Chinese company might require around $20 million in revenue to break even, compared with $100 million for a U.S. company, he said. “The risk is much lower in China,” he said。

北极光创投的杨磊说,中国清洁技术公司需要的资金通常比美国公司要少。他说,例如一家中国公司实现收支平衡可能只需收入达到2,000万美元左右,而美国公司则需要1亿美元。杨磊说,投资中国的风险要小很多。

Last year, investments from PE, VC and other types of investors into China-based clean technology companies fell to $1.96 billion, compared to $3.91 billion in 2011 and $4.04 billion in 2010, according to figures from data provider Dealogic. Active investors in the sector include Tsing Capital, which in 2012 invested in Ningbo Qinyuan Group, a manufacturer of water treatment equipment, as well as Olympus Capital and FountainVest Partners, which were some of the investors in Zhaoheng Hydropower Holdings Ltd。

据数据提供商Dealogic统计,去年私募、风投和其它类型的投资对在华清洁技术公司的投资降至19.6亿美元,低于2011年的39.1亿美元和2010年的40.4亿美元。该行业的积极投资者包括2012年投资了水处理设备制造商宁波沁园集团有限公司(Ningbo Qinyuan Group)的青云创投(Tsing Capital),以及投资了兆恒水电股份有限公司(Zhaoheng Hydropower Holdings Ltd)的泰山投资和方源资本(FountainVest Partners)。

One Beijing-based lawyer said the lackluster performance of 2012 may have been on the back of a collapse in valuations in the solar industry in China, as well as the rest of the world, denting investor sentiment。

一位常驻北京的律师说,2012年之所以表现黯淡,可能是由于中国以及世界其它国家和地区的太阳能产业估值暴跌,投资者信心受到打击。

Investors are seeing valuations of certain clean-technology companies also come back down to “more rational levels,” for example, in areas that relate to water treatment and emission reduction, said Gary Rieschel, founder of Qiming Ventures. The firm is looking at investing in a water treatment company, he said, declining to provide further details。

启明创投(Qiming Ventures)的创始人瑞斯彻(Gary Rieschel)说,投资者发现与水处理和减排有关的某些清洁技术公司其估值回到了“更理性的水平”。他说,启明创投正考虑投资一家水处理企业,但拒绝透露更多详情。

Qiming in the middle of last year increased its allocation to clean tech investments to 15%, from under 10%。

去年年中,启明创投投资清洁技术公司的比例从不到10%提高至15%。

Meanwhile, Northern Light is also looking at companies that develop fuel cells, which could be used as an alternative to coal one of the main contributors to China’s pollution problem. The firm previously invested in one such company called Pearl Hydrogen in 2010. Northern Light will invest in four to five new companies this year from its $400 million third fund, and a yuan-denominated vehicle equivalent to around $100 million, said Yang。

与此同时,北极光创投在关注开发燃料电池的企业。这种电池可取代造成中国污染问题的一大元凶煤炭。2010年,北极光创投曾投资了这样一家企业上海攀业氢能源科技有限公司(Pearl Hydrogen)。杨磊说,他们今年将再投资四五家新公司,所投资金来自北极光创投规模4亿美元的第三只基金和一个大约1亿美元的人民币计价投资工具。

- 双语关注:沙尘天话“空气质量”(图)2010-03-23 10:43

- 趣味双语:日本玩具商制造出空气吉他(图)2007-07-09 10:59

- 双语阅读:爱情丰碑印度泰姬陵被污浊空气困扰2005-02-24 16:26

- 你被空气污染了没:“雾霾”英语怎么说2013-01-15 14:31

- 减少交通流量就会减少空气污染2007-11-19 07:15