辞职做全职奶爸奶妈有风险 入行须谨慎(双语)

扫描关注少儿英语微信

辞职做全职奶爸奶妈有风险 入行须谨慎

辞职做全职奶爸奶妈有风险 入行须谨慎对于任何家庭而言,夫妻一方辞职在家带孩子都是件大事。诚然,任何人都不能替夫妻做这样一个决定。但是,以下五条建议可供其参考:

第一、夫妻收入能否满足开支需要?

这个问题似乎显而易见,但生活中很容易遗漏一些小的开支项。此外,建议夫妻不要对以下情况所持态度过于乐观,诸如物价稳定,持续加班或兼职等等。统计一个月或两个月的花销情况是个好主意,以便于你清楚收入的来龙去脉,而不至于看到账单上的数字傻了眼。

第二、如不工作,储蓄会低于预期

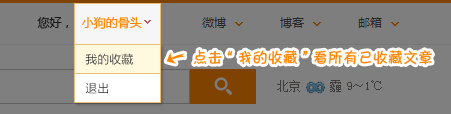

“入行”须谨慎" border="1" align="middle">

当然,夫妻一人在家带孩子可省去一笔不小的开销,诸如雇用保姆、外出就餐、衣物干洗、交通费用等等。但是,在家看孩子的开支项也不少,虽然并未具体到做晚饭这类事。且不说给孩子买玩具得花钱,如果没有亲朋好友帮忙照看孩子,你还时不时地需要雇保姆看孩子,以便于你能抽身去看医生或牙医等。理论上来说,大家容易产生这样一种想法,即全职奶爸/奶妈的家庭有利于储蓄。但是,很多事只有你试了才知道和预想之间的差别。

第三、全职奶爸/奶妈重返职场受多大影响?

如果你计划等孩子上学后重返职场,那么你会发现很难找到类似离职前的工作。事实上,你不仅再不可能找回缺席职场的那几年时光,而且还会发现发展前景受到诸多限制。对于全职奶爸/奶妈而言,亲自陪伴孩子成长的“得”和职场的“失”之间远未达到一种平衡。

全职奶爸/奶妈这段人生经历究竟会在多大程度上影响你的职业生涯,取决于以下诸多因素:工作领域、离职时间、重返职场时的经济现状等等。对于这个问题,你要如实的叩问自己,选择做一名全职奶爸/奶妈对个人发展和长期理财目标的影响究竟有多大。

第四、家庭是否拥有一张经济安全网?

如果家里的顶梁柱出现失业、受伤或生病等意外,家庭能否熬过收入微薄的数月?如果生活中出现天灾人祸,家庭又是否有应急基金?

此外,家庭储蓄能否应对一些必要开支项,诸如房屋和汽车维修费,纳税和医疗费用?毫无疑问,家庭收入仅能保障每月的生活是远远不够的,而应拥有足够的积蓄去应对未来可能出现的长达数周、甚至数月的生活低谷期。

第五、夫妻是否处于同一频道

夫妻之间的交流很是重要,因为双方均容易感受到忽视、误解和想当然等不良情绪。全职奶爸/奶妈通常会产生这样一种想法,即鉴于自己“赋闲在家”,所以家庭地位较低。与此同时,作为家庭唯一收入来源的“顶梁柱”会压力过大,而且觉得个人付出未受到重视。

交流固然重要,但倾听也必不可少。交流过程中,应让对方感受到你的倾听。做出成为全职奶爸/奶妈的决定前,应将方方面面的问题考虑周全。当然,还可根据实际情况对原计划予以定期调整。

对于一个家庭而言,由爸爸或妈妈亲自陪伴孩子成长是一件很棒的事情。但是,这并非意味着,只有这一种途径能保障孩子健康、快乐地成长。如果这个选择适合你的家庭,那就为选择的顺利实施全力准备吧!

原文:

Five Things to Consider Before Becoming a Stay at HomeParent

Deciding to have one parent stay at home with the children isa huge decision that’s complicated by the emotions involved. Nobodycan make this decision for you, but here are five things toconsider before you make the decision。

1. Will the working spouse’s salary be enough to cover thebills?

Seems like an obvious question, but it’s easy to forget aboutall of those little expenses and not be overly optimistic aboutprices remaining the same, continued availability of overtime orside work and so on. It could be a good idea to track your spendingfor a month or two so that you know every penny you spend, not justthe numbers on your bills。

If your little one has not been born yet, be sure to accountfor his or her expenses. Allow yourself a very ample cushion,because…

2. You might not be able to save as much as you’d think by notworking。

Of course, not paying for day care is a huge savings and youcan save a bundle on lunches out, clothing and dry cleaning andcommuting costs。

However, there are plenty of ways for stay at home parents(SAHPs) to spend money! It might not be as practical as you thinkto cook from scratch every night. That garden might turn out tohave been a pipe dream. You’ll want to provide your childwithenrichment activitiesthat could cost money. If there aren’tfriends and family members to provide occasional child care, you’llstill need to hire sitters for doctor and dentist visits and soon。

It’s easy enough to think of all the ways stay at home parentscan save money in theory, but you never know what the reality isgoing to be until you live it – and even then it’s apt to changeevery few months as your children grow and change。

3. How much is this going to affect your long term careerprospects and how much do you care?

if you’re planning on going back to work after the kids are inschool, you might find that it’s difficult to get a job comparableto the one you left. It might never be possible to regain the yearsyou lost in your career and you might find that your advancementprospects are limited. There can be a veryreal financial price tobeing a stay at home parentthat goes beyond just the years youraised your children。

How much will it matter? That depends on your career field,how many years you are absent from the work force and the state ofthe economy when you decide to go back. Do be honest and askyourself how much this will matter to you on a personal level aswell as take a hard look at how it will affect your long termfinancial goals。

4. Do you have an adequate safety net?

If the breadwinner is laid off, hurt or becomes ill do youhave the reserves to weather several months of very little incomecoming in? Do you have an emergency fund to handle things like thefridge dying or the basement flooding?

Will you be able to save money for inevitable expenses likehome and car maintenance, taxes and medical bills? It’s not enoughto know that you have the cash to make it through each month, youhave to know that you’ll have enough for several weeks or months ofrainy days, too. Consider the possibility of thestay at home parentworking part timeor working freelance to contribute to a safetynet。

5. Am I on the same page as my partner?

Communication is crucial, it’s very easy for one or both ofthe spouses to feel ignored, unappreciated and taken for granted.It could be that the stay at home spouse feels like they don’t haveequal power in the relationship because they aren’t bringing inmoney. Or the working spouse might feel pressured by being the solesource of income and feel that their hard work isn’t respected。

Talking to your spouse is important but don’t forget to listenand make sure they know that you have heard their point of view.You’ll want to hash things out before the decision is made to stayhome and then periodically to make adjustments as your situationchanges。

If your relationship is already in trouble, be cautious aboutmaking the decision to stay home. It could have a positive affectas the stress of two working parents can be fierce, but it couldjust as easily increase resentment and leave the spouse who is athome in a very bad financial bind。

Having one parent stay at home with the children can be awonderful choice for a family but it’s not the only way to raisewonderful, healthy, happy children. If this is the right choice foryour family, do go into it with open eyes and amplepreparation。

How did you make the decision to stay at home or continueworking?

本文选自ddfffff_63244的博客,点击查看原文。

- 双语囧研究:吃得少记性才能好(图)?2015-08-26 15:53

- 双语揭秘:生活中最令人沮丧的真相(图)2015-08-26 15:34

- 儿童睡前双语小故事:上帝的小孩(图)2015-08-26 15:27

- 经典双语美文:你是一个成功者吗(图)2015-08-26 15:11

- 双语:新生熊猫宝宝首次亮相 睡姿萌化人(图)2015-08-26 15:07