不支持Flash

|

09注会原制度考试《财管》试题及参考答案(8)

4)G公司3月份预测销售情况:

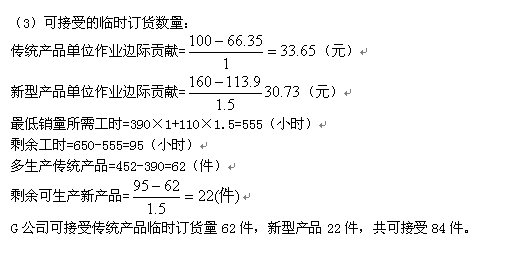

公司根据长期合同和临时订单预计的3月份的最低销售量为500件,其中传统产品390件,新型产品ll0件;最高销售量为602件,其中传统产品452件,新型产品l50件。

要求:

(1)采用实际作业成本分配率分配作业成本,计算填列G公司传统成品和新型产品的产品成本计算单(计算结果填入答题卷第l3页给定的表格内)。

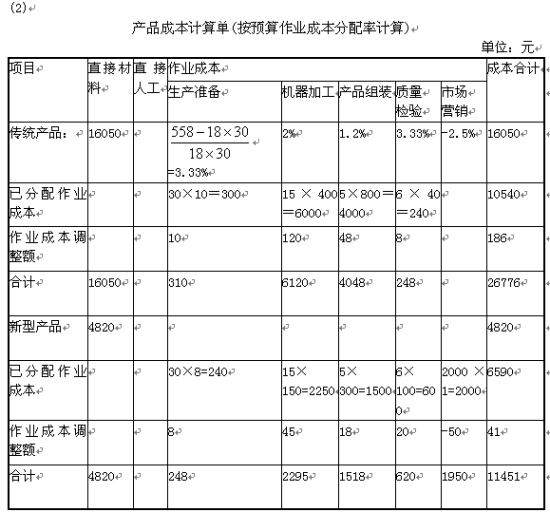

(2)采用预算作业成本分配率分配作业成本(分配时需计算成本差异调整率和调整额,将成本差异分配到有关产品),计算填列G公司传统产品和新型成品的产品成本计算单(计算结果填入答题卷第l3页给定的表格内)。

(3)假设除与机器加工作业相关的机器设备和厂房外,其他资源都可按需随时取得,并且G公司可与客户协商减少部分临时订单的供应数量,计算为使G公司利润最大化,G公司可接受的临时订货数量。

【答案】

六、英文附加题(本题型共2题,每题5分,共l0分。要求用英文解答,列出计算步骤,每步骤运算得数精确到小数点后两位。请在答题卷上解答,答在试题卷上无效。)

1.M company is a manufactory which produces toys.The budgeted production and sales of the company are both expected to be 200 units in the coming year,the budgeted selling price is$370 per unit.The following information relates to the costs of producing 200 toys:

Per unit($)

Total($)

Direct material costs

l 50

30 000

Direct labor costs

80

1 6 000

Variable production overheads

50

1 0 000

Variable selling and administration overheads

30

6 000

Fixed production overheads

6 000

Fixed selling and administration overheads

3 000

Requirement:

A.Calculate the total contribution margin。

B.Calculate the amounts of profit at the budgeted level of production。

C.Calculate the break-even point in units and the margin of safety。

D.If M company desires a profit of$4 800,calculate the number of units that it must produce and sell。

2.For the year just ended,N company had an earnings of$2 per share and paid a dividend of $1.2 on its Stock.The growth rate in net income and dividend are both expected to be a constant 7 percent per year,indefinitely.N company has a Beta of 0.8,the risk-free interest rate is 6 percent,and the market risk premium is 8 percent。

P Company is very similar to N company in growth rate,risk and dividend payout ratio.It had 20 million shares outstanding and an earnings of$36 million for the year just ended。

The earnings will increase to$38.5 million the next year。

Requirement:

A.Calculate the expected rate of return on N company’s equity。

B.Calculate N Company’s current price—earning ratio and prospective price-earning ratio。

C.Using N company’s current price-earning ratio,value P company’s stock price。

D.Using N company’s prospective price-earning ratio,value P company’s stock price。

1.

A. Total contribution margin=370*200-(150+80+50+30)*200=370*200-310*200

=12000

B. The amounts of profit at the budgeted level of production=12000-(6000+3000)=3000

C. Break-even point in units=(6000+3000)/(370-310)=150

The margin of safety=(200-150)*370=18500

D. 4800=(370-310)*Q-9000

The number of units=(4800+9000)/(370-310)=230

2.

A. The expected rate of return on N company’s equity=6%+0.8*8%=12.4%

B. current price-earning ratio=(1.2/2)*(1+7%)/(12.4%-7%)=11.89

Prospective price-earning ratio=(1.2/2)/(12.4%-7%)=11.11

C. P company’s stock=11.89*36/20=21.4

D. P company’s stock=11.11*38.5/20=21.39

【答案】

1.

A.Total contribution margin=370×200-(150+80+50+30) ×200=370×200-310×200

=12000

B.The amounts of profit at the budgeted level of production=12000-(6000+3000)=3000

C.Break-even point in units=(6000+3000)/(370-310)=150

The margin of safety=200-150=50

D.4800=(370-310) ×Q-9000

The number of units=(4800+9000)/(370-310)=230

2.

A.The expected rate of return on N company’s equity=6%+0.8×8%=12.4%

B.current price-earning ratio=(1.2/2) ×(1+7%)/(12.4%-7%)=11.89

Prospective price-earning ratio=(1.2/2)/(12.4%-7%)=11.11

C.P company’s stock=11.89×36/20=21.4

D.P company’s stock=11.11×36×(1+7%)/20=21.40

特别说明:由于各方面情况的不断调整与变化,新浪网所提供的所有考试信息仅供参考,敬请考生以权威部门公布的正式信息为准。

网友评论

更多关于 注会 的新闻

- 2009年新注会考试设英语选答题2009-09-01 11:08:59 京华时报

- 注会旧制度《财管》考试题目及参考答案(2)2009-08-31 12:17:03 中华会计网校

- 注会旧制度《财管》考试题目及参考答案(4)2009-08-31 12:17:03 中华会计网校

- 注会旧制度《财管》考试题目及参考答案(3)2009-08-31 12:17:03 中华会计网校

- 2009注会旧制度《财管》考试题目及参考答案2009-08-31 12:17:03 中华会计网校

- 2009注会旧制度《经济法》试题及参考答案(2)2009-08-31 11:55:25 中华会计网校

- 2009注会旧制度《经济法》试题及参考答案(9)2009-08-31 11:55:25 中华会计网校

- 2009注会旧制度《经济法》试题及参考答案(6)2009-08-31 11:55:25 中华会计网校